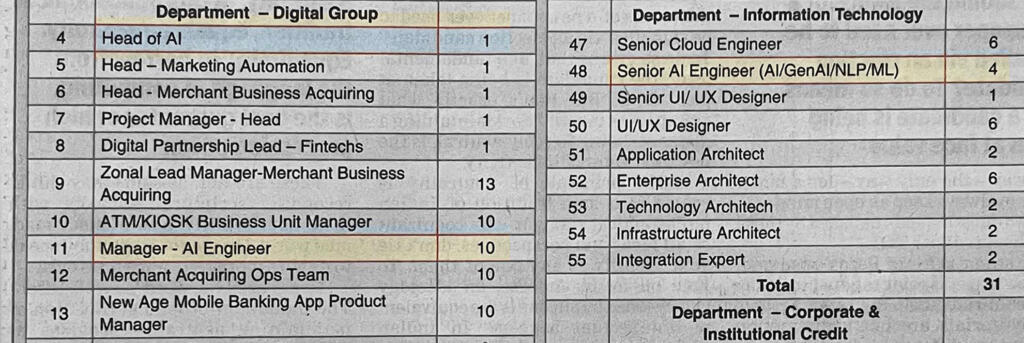

The recent advertisement from the Bank of Baroda seeking AI talent marks a significant milestone in the Indian banking sector’s digital transformation journey. This public sector bank’s move to hire AI professionals, including positions like Head of AI and Senior AI Engineers, signals a broader shift in how traditional banking institutions are embracing cutting-edge technology.

What makes Bank of Baroda’s AI initiative particularly noteworthy is its comprehensive approach to digital transformation. The bank has already implemented several AI-driven solutions, including Aditi, their virtual relationship manager that provides 24/7 customer support across multiple languages and handles routine banking queries. Their GyanSahay.AI serves as an internal knowledge repository, empowering employees with instant access to banking policies and facilitating continuous learning. Additionally, ADI (Advanced Digital Interface), their specialized GenAI chatbot, streamlines digital banking operations and enhances customer experience through personalized interactions. Recently, they conducted a GenAI Hackathon 2024 in collaboration with Microsoft, showcasing their vision for this technology.

Bank of Baroda conducted GenAI Hackathon 2024 with Microsoft

The landscape of AI adoption in Indian banking presents an interesting contrast between public and private sectors. Private banks like HDFC Bank with its EVA (Your Personal Assistant) and ICICI Bank with iPal have been early adopters of AI technology. State Bank of India’s YONO platform and Punjab National Bank’s AI-based credit assessment systems demonstrate that public sector banks are quickly catching up. This healthy competition is driving innovation across the sector, with both public and private banks investing heavily in AI-powered solutions for everything from customer service to risk management.

Axis Bank assures AI will transform roles, not eliminate jobs

Axis Bank’s approach to AI integration offers an important perspective on the future of banking jobs. The bank has explicitly stated that AI implementation won’t lead to job losses but rather to a transformation of roles. This aligns with the broader industry trend where AI is seen as a tool to enhance human capabilities rather than replace them. Employees are being retrained to focus more on complex decision-making and customer relationship management, while AI handles routine tasks.

The Indian government’s proactive stance through initiatives like NITI Aayog’s National Strategy for AI has created a supportive environment for such technological advancement. This strategy aims to position India as a leader in AI, focusing on key areas including banking and financial services. Also, the IndiaAI Mission selected eight projects under the ‘Safe and Trusted AI Pillar’ initiative of the Government of India, further demonstrating the country’s commitment to leading in AI development.

However, these transformations in Banks comes with its share of challenges. Banks must navigate issues like legacy system integration, data privacy concerns, and the need for comprehensive employee training. The investment required for AI implementation is substantial, both in terms of technology infrastructure and human capital development.

Looking ahead, the benefits of AI integration in banking are clear: improved operational efficiency, enhanced customer experience, better risk management, and more personalized banking services. The Bank of Baroda’s recruitment drive represents more than just hiring; it’s a strategic move towards building a future-ready banking institution that can compete effectively in an increasingly digital world.

As public sector banks continue to invest in AI capabilities, the traditional gap between public and private sector technology adoption is narrowing. This evolution promises a more competitive and efficient banking ecosystem that benefits all stakeholders—from customers enjoying better services to employees developing new skills for the digital age. The success of these initiatives will likely inspire other public sector institutions to follow suit, accelerating the digital transformation of India’s financial sector with Artificial Intelligence.